Due Date to file ACA Forms

1095-B/1095-C

Recipient copy Deadline

March 03, 2025

Paper filing Deadline

February 28, 2025

E-Filing Deadline

March 31, 2025

Visit https://www.taxbandits.com/aca-forms/form-1095-c-due-date/ to know more about State filing

ACA Form deadlines.

Information Required to File ACA Forms 1095-B/1095-C Online

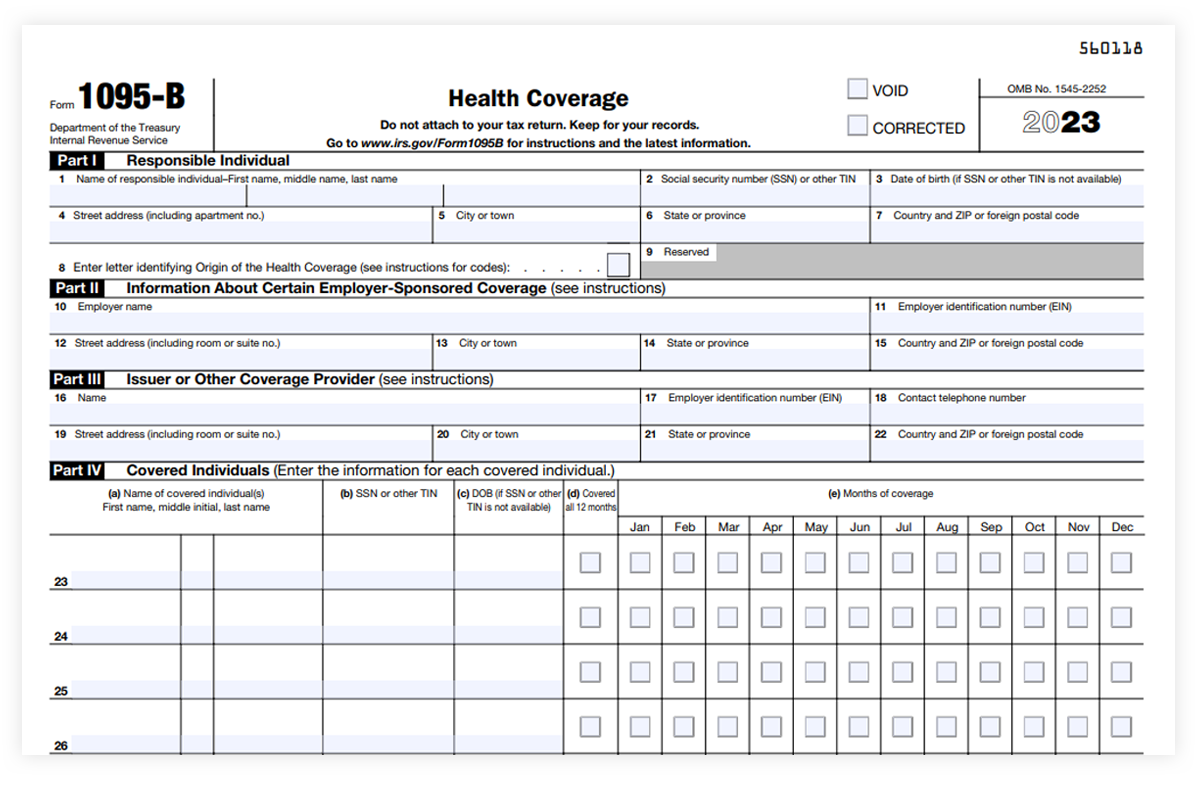

Form 1095-B

The information required to

file Form 1095-B is:

- Responsible individual’s basic information (Name, SSN, date of birth, address)

- Employer’s basic information (Name, EIN, date of birth, address)

- Basic information of the issuer or other coverage provider (Name, SSN, date of birth, address)

- Details about the covered individuals (Name, SSN, months of coverage offered)

Click here to know more about Form 1095-B Instructions.

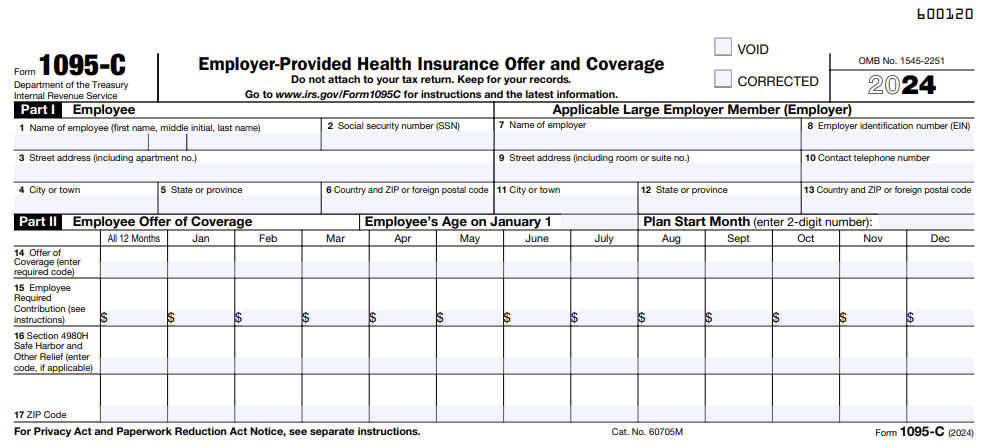

Form 1095-C

The information required to

file Form 1095-C is:

- ALE’s basic information (Name, EIN, Address)

- Employees’ basic information (Name, EIN, Address)

- Employee offer of coverage details (ACA Codes and plan details)

- Details about the covered individuals (Name, SSN, months of coverage offered)

Click here to know more about Form 1095-C Instructions.

How to E-File ACA Forms 1095-B/1095-C for the

2024 Tax Year

Filing Forms 1095-B/1095-C electronically is extremely easier with TaxBandits. Create a free account with TaxBandits and follow these steps:

- Step 1: Choose Form 1095-B / Form

1095-C - Step 2: Enter the coverage provider and covered individuals details

- Step 3: Enter form information

- Step 4: Transmit your Form to the IRS and State

- Step 5: Deliver Recipient Copy (Online/Postal)

File 1095-C Online with the IRS authorized software and E-File 1095-C Now.

Features

Supports State filing

Some states may require the filers of

ACA forms to complete the ACA reporting at the state level. With TaxBandits, you can meet your state filing requirements as well as the IRS filing requirements.

Multi-user access

Using our multi-user access feature, you can provide the other members of your organization with individual access to your TaxBandits account. Once granting them access, you can have these users edit, prepare, review, and transmit any ACA forms on your behalf. In addition, the activity log lets you track their actions as well.

Employee Copy Distribution

Not just the e-filing of your ACA forms to the IRS and state, TaxBandits also helps you distribute the form copies to the corresponding recipients with our postal mailing feature. You can also provide online access to the recipient and have them view and download the form copies.

ACA Corrections

Making corrections in the ACA Forms that you’ve filed with TaxBandits is quite easy and simple. We will audit your forms for errors using the IRS Business Rules and support you in distributing the corrected employee copies as well.

Bulk Upload Templates

If you are filing 1095-B Form / 1095-C Form for multiple EINs or a large number of employees, our bulk upload templates can save a lot of your time. You can just download the templates, update the information and upload it back to our system.

Multiple tax year support

Need to complete your ACA reporting for the previous years? TaxBandits paves the way for you to e-file your ACA forms for both the current tax year and prior years.

Pricing to e-file ACA Forms Online with the IRS

Check out the budget-friendly prices for e-filing your ACA Forms. You can file an ACA return at $2.99.

| Types of Services | No. of Forms (per form pricing) | ||||

|---|---|---|---|---|---|

| First 49 Forms | Next 51 Forms | 101-250 Forms | 251-500 Forms | 501-1000 Forms | |

| 1095 Federal E-File | $2.99 | $2.49 | $2.29 | $2.09 | $1.99 |

| 1095 State E-File | $1.50 | $1.50 | $1.50 | $1.50 | $1.50 |

To know more about the pricing details of postal mail, online retrieval, corrections, and state-only filings, Click here.

Form 1095-B/1095-C Extension

If you aren’t able to complete your ACA reporting within the deadline, you can file Form 8809 and get an automatic extension for 30 days from the IRS. The extension form can be submitted either on paper, or electronically.

Helpful Resources

E-File Form 1095-B/1095-C Accurately with our Software

Contact Us

Have more questions on how TaxBandits eases your ACA Reporting process? Get in touch with our support team.